Loan Usage

Export Financing

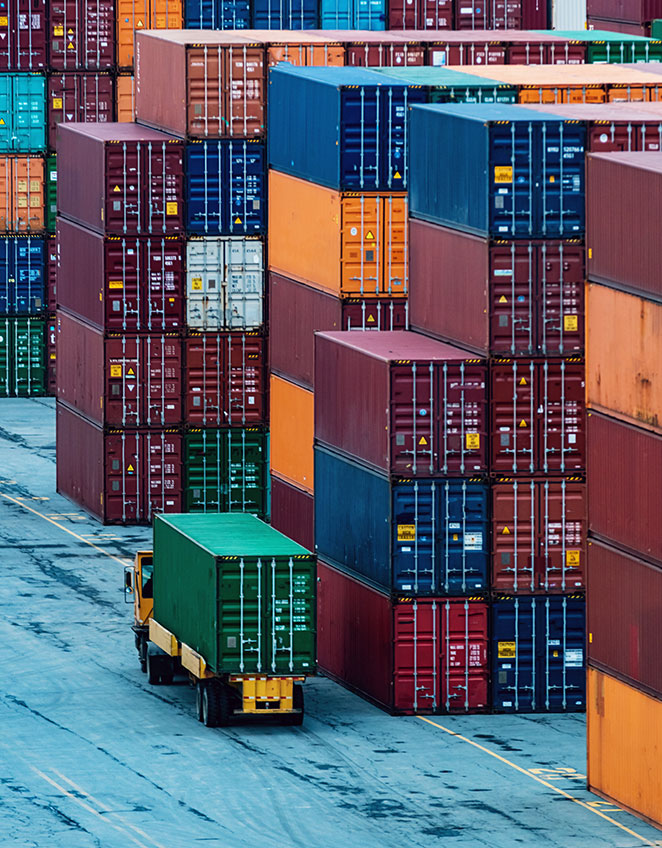

Use an SBA loan to expand your business overseas

Struggling to secure funding for your export business?

Small businesses often hit financial roadblocks when trying to secure export financing, making global expansion more challenging. A major hurdle is the perceived risk involved in exporting. Traditional lenders are often cautious about offering loans for exports due to concerns about currency fluctuations, payment delays, and political or economic instability in foreign markets. As a result, small businesses can face fewer financing options or be saddled with higher interest rates.

Another pressing issue is cash flow. Exporting typically involves longer payment terms, meaning businesses might wait months before getting paid by international buyers. This can strain cash reserves, especially with the upfront costs of production, shipping, and other operations. On top of this, small businesses must navigate the complex regulations of international trade, including customs paperwork and compliance with foreign laws, which can further increase the cost and complexity of securing export financing.

Use export working capital to smooth out cash flow

Export businesses facing financing challenges, should consider the SBA loan program for their financing needs. The SBA’s 7a Loan Program offers a valuable solution by providing loans of up to $5 million for businesses looking to expand internationally. With flexible use of funds, 7a loans can be used to purchase inventory, cover operating expenses, or finance working capital—helping businesses maintain cash flow while waiting for payments from international buyers. Additionally, the SBA guarantees a portion of the loan, which encourages lenders to approve financing that might otherwise be considered too risky.

Similarly, the 504 Loan Program can also be an asset for export businesses looking to finance large fixed assets such as warehouses or manufacturing equipment. The 504 loan also provides up to $5 million for real estate and equipment, allowing businesses to scale their operations to meet growing international demand. With lower down payments and fixed interest rates, the 504 program offers cost-effective financing to support expansion.

First Bank of the Lake, with over $1.1 billion in SBA loans funded, specializes in helping small business owners, including exporters, access these SBA programs to fuel their growth and overcome financial barriers to international trade.

The Numbers

in Loans 2024

Largest SBA Lender^

Small Businesses Helped 2020-2024

It's Easy to Get Started

Contact Us

What Type of Loan?

Find out more about the SBA loan application process from our advisors determining what type of loan you need.

Assemble Your Documents

Put together an SBA loan application with the supporting documents.

Submit Your Application

Submit your SBA loan application.

SBA Industry Loans

Talk to an SBA Export Financing Expert Today

We made $600MM in SBA loans in the last year alone