Business Banking

Beneficial Ownership

Required information for new and existing accounts.

Home » Business Banking »

Beneficial Ownership Certification

Federal regulations now require all financial institutions to obtain and verify information about the key individuals who ultimately own and/or control a legal entity to assist law enforcement in investigating and counteracting money laundering, tax evasion, and other financial crimes.

Here are some recommendations for seamless compliance with the Beneficial Ownership Rule.

Be Proactive

- Bringing a hard copy of the completed and signed form to your appointment will help speed up the process of opening a new account.

- For existing accounts, learn the threshold First Bank of the Lake requires for beneficial owners (minimum of 25% equity interest).

Confirm Accuracy

- Allow time to complete the form. Confirm the required information in the form is correct with no spelling errors.

Communicate

- Stay in communication with stakeholders of your organization to complete the form and submit it in a timely manner.

- Reach out to your First Bank of the Lake representative if there is a change in beneficial ownership at your organization.

When opening an account at First Bank of the Lake, the Beneficial Ownership Form must be completed by the Natural Authorized Person (NAP).

The form requires, among other information, the name, business address or primary residence address, date of birth, Social Security Number (as applicable), the name of the issuing state or country, and number of the passport or driver’s license for the Beneficial Owners and Control Person as applicable.

Contact Us

We’re here to help.

Frequently Asked Questions (FAQs)

What is the Beneficial Ownership Rule?

Beneficial Ownership is a requirement from the Financial Crimes Enforcement Network (FinCEN), under the Bank Secrecy Act, which mandates all covered financial institutions collect and verify from certain non-exempt legal entities specific information about the beneficial owners of the entity at the time a new account is opened. The intent of the Beneficial Ownership Rule is to assist authorities in counteracting money laundering, tax evasion, and other financial crimes.

Who is considered a Beneficial Owner?

A Beneficial Owner is each individual or business entity, if any, who, directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise, owns 25% or more of the equity interests of the legal entity. An additional Certification of Beneficial Ownership must be completed for every business Entity Owner until human ownership is established. This could be an individual or another business entity.

You will be required to provide the following information for each beneficial owner:

- Name

- % of Ownership

- Date of Birth

- Address (Residential or Business Street Address)

- For U.S. Persons: Social Security Number

- For Foreign Person: Passport Number and Country of Issuance, or other similar identification number.

* In lieu of a passport number, foreign persons may also provide an alien identification card number, or number and country of issuance of any other government-issued document evidencing nationality or residence and bearing a photograph or similar safeguard.

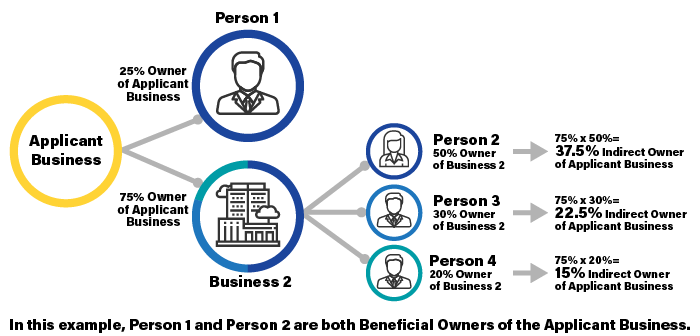

If my business is owned by another business, who are my Beneficial Owners?

Beneficial ownership should pierce through corporate layers down to the individual. Multiply the percentages owned of each company to find each individual indirect ownership percentage in the applicant business. Anyone with 25% or more direct or indirect ownership would be a Beneficial Owner of the applicant business.

The following graphic is an example of calculating Beneficial Ownership when owned by another business.

Who is the individual with significant responsibility for managing the legal entity?

The one individual with significant responsibility for managing the legal entity listed in item, such as: an executive officer or senior manager (e.g. Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Managing Member, General Partner, President, Vice President, Treasurer); or Any other individual who regularly performs similar functions.

You will be required to provide the following information for this individual:

- Name/Title

- Date of Birth

- Address (Residential or Business Street Address)

- For U.S. Persons: Social Security Number

- For Foreign Person: Passport Number and Country of Issuance, or other similar identification number*

* In lieu of a passport number, foreign persons may also provide an alien identification card number, or number and country of issuance of any other government-issued document evidencing nationality or residence and bearing a photograph or similar safeguard.

Who is a Natural Authorized Person (NAP)?

An individual authorized to open accounts or provide information on behalf of the legal entity.

- Legal entity

- Corporation

- Limited liability company

- Partnership

- Other entity created by filing a public document with a Secretary of State or similar office

- General partnership

- Any similar entity formed under the laws of a foreign jurisdiction that opens an account

A legal entity does not include

- Sole proprietorship or unincorporated association.

- Refer to the section on exclusions and exempt below for more details on whether your company is impacted by this requirement.

Which Entities are Excluded?

The following legal entities are excluded from the Beneficial Ownership Rule and do not require the collection of Beneficial Ownership information or evidence supporting their exclusion:

- Sole Proprietorships

- Unincorporated Associations

- Trusts (other than statutory trusts created by a filing with the Secretary of State or similar office)

- Authorized Users for credit cards

- Non-Account Owners

Which Entities are Exempt?

Legal entities in one of the following categories are generally exempt from the Beneficial Ownership Rules requirements. However, a completed form detailing exemption reasons and signed by the NAP will be required with the first account opened after the FinCEN regulatory date.

- Entities traded on a U.S stock exchange (NYSE, American or NASDAQ).

- A charity or non-profit entity (requires a Control Person).

- Trusts (not formed through a Secretary of State filing).

- A Public Accounting firm registered under section 102 of the Sarbanes-Oxley Act.

- A Bank regulated by a U.S. state agency.

- An Insurance company regulated by a state of the United States.

- A U.S regulated financial institution.

- An agency of the U.S. Federal government.

- An agency of a U.S. State government.

- A U.S. local government agency.

- A non-U.S. government agency engaged in government activities.

- A bank holding company.

- A savings and loan holding company.

- Equipment Finance/Leasing transactions that are purchases from third parties as First Bank of the Lake is not the originating bank.

- A financial market utility designated by the Financial Stability Oversight Council.

- A non-U.S. entity opening a private banking account subject to 31 CFR

- A foreign Financial Institution established in a jurisdiction where the regulator of such institution maintains Beneficial Ownership information (requires review and approval by First Bank of the Lake).

- An issuer of a class of securities.

- An SEC registered investment company, investment advisor, broker dealer or other registered firm with a current SEC registration number.

- A Commodity Futures Trading Commission registered entity.

- A pooled investment vehicle that is operated or advised by a financial institution that is exempt from Beneficial Ownership.

- Non-excluded pooled investment vehicles—those not operated by or advised by a financial institution such as a non-US managed mutual fund, hedged fund or private equity fund (requires Control Person).

- An Entity, organized under the laws of the United States, with at least 51% of whose commons stock or analogous equity interest held by an entity traded on a U.S. Stock Exchange.

- Unincorporated Associations (such as scout troops or youth sport leagues) (Unincorporated Associations are excluded and are not required to provide beneficial ownership and signature from a Natural Authorized Person).

When is Beneficial Ownership information is Required?

Beneficial Ownership information is required with each account opening, or if there were changes in beneficial ownership since last certifying for your organization. It may also be requested by First Bank of the Lake. Recertification is required for each subsequent account opening.

For more information on this regulatory requirement and how it impacts you, please contact your First Bank of the Lake business banker.

What will First Bank of the Lake do with this information?

We are required to maintain this information as part of our records that are associated with your legal entity. We treat this information with the same high level of confidentiality and security as we do all our customer information.

For more information on this regulatory requirement and how it impacts you, please contact your First Bank of the Lake business banker.

How Can We Help You?

Contact Us (Consumer)

We're here to help with your consumer and business banking needs

Contact Us (Business)

We're here to help with your SBA lending needs

Helpful Numbers

List of bank phone numbers

Locations

View our locations and lobby hours

Lost/Stolen Card

What to do if your card is lost or stolen

Education Center

High quality financial education for free

Mobile Banking

Bank on the go 24/7 with Mobile Banking

Calculators

Use our free financial calculators

Open Online Account

Apply for a new CD or High Yield Savings Account Online

Order Checks

Order checks quickly and easily

Schedule of Fees

View a list of bank fees for some of our convenience services

Security

Dozens of security tips to help you stay safe online

How Can We Help You Today?

Get Your Questions Answered Promptly