SBA Loans

We’ve funded over 2,000 loans for over $1.1 billion nationwide

Home »

Learn About SBA Loans From an Expert

Talk to an SBA loan expert today. Learn about 7a loans which are shorter term and more flexible, 504 loans which are longer term and typically for real estate and how to find working capital for your business.

SBA Loans

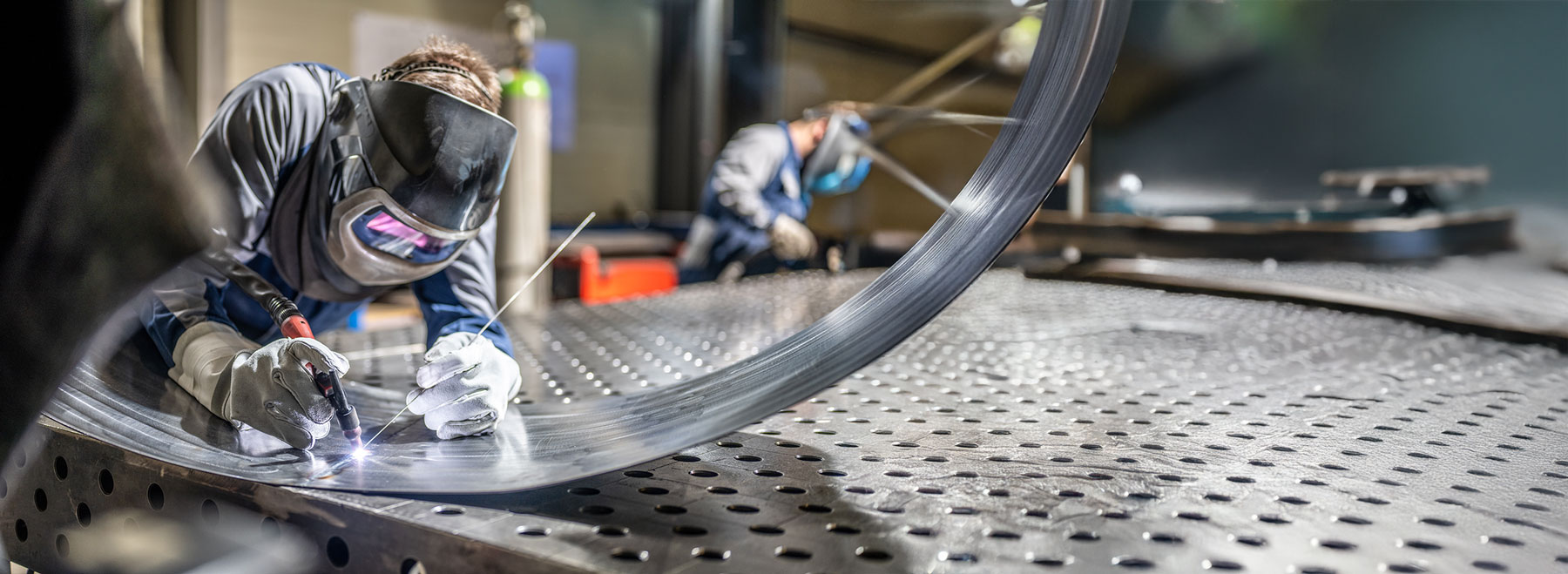

SBA government loans can be used for business expansion, purchasing real estate, equipment purchase and many other purposes. We make loans to more than 40 industries.

SBA Loans

SBA government loans can be used for business expansion, purchasing real estate, equipment purchase and many other purposes. We make loans to more than 40 industries.

SBA 7a Loans

SBA 7a loans are US government backed loans that can be used for tenant improvements, equipment purchase, location expansion, partner buyout and much more.

SBA 7a Loans

SBA 7a loans are US government backed loans that can be used for tenant improvements, equipment purchase, location expansion, partner buyout and much more.

SBA 504 Loans

SBA 504 loans are the popular option for buying commercial real estate and longer term purchases for your business. They are less flexible but have below-market fixed interest rates.

SBA 504 Loans

SBA 504 loans are the popular option for buying commercial real estate and longer term purchases for your business. They are less flexible but have below-market fixed interest rates.

SBA Working Capital Loans

SBA 7a loans are US goverment backed loans that can be used for short-term operational expenses, such as rent, payroll, permits, licensing, marketing, inventory and much more.

SBA Working Capital Loans

SBA 7a loans are US goverment backed loans that can be used for tenant improvements, equipment purchase, location expansion, partner buyout and much more.

USDA Loans

USDA loans are made through the U.S. Department of Agriculture and are designated for communities under 50,000. They are known for longer loan terms and lower down payments for rural small businesses.

USDA Loans

USDA loans are made through the U.S. Department of Agriculture and are designated for communities under 50,000. They are known for longer loan terms and lower down payments for rural small businesses.

SBA Loan Articles

7a Loans Guide

Learn about 7a loans in detail from the experts

504 Loans Guide

Check out our comprehensive guide to SBA 504 loans

7a vs 504 Loans

Understand the two main SBA loan types

Client Success Stories

Learn the details of many of our clients’ SBA loans

SBA Loans By Industry

We support over 30 industry verticals for SBA loans

SBA Loans By Use of Funds

SBA loans can be used for almost any business purpose

SBA Loan Articles

Check out dozens of articles explaining SBA loans

SBA Loans for Veterans

Learn about our extensive SBA loan benefits for vets

SBA Loans for Franchises

We are one of the top SBA franchise lenders in the country

SBA Loans ePubs

Download our free SBA loan ePubs to learn more

The Numbers

in Loans 2024

Largest SBA Lender^

Small Businesses Helped 2020-2024

SBA Industry Loans

Talk to an SBA Loan Expert Today

We made $600MM in SBA loans in the last year alone